With the economy returning to normalcy post-COVID, the Real Estate sector’s GDP contribution increased by 15.43 % in the third quarter of 2021. However, increased cost of building materials, rise in the currency exchange rate, and inflation reached 15.63% by December 2021 despite hitting a peak at 18.17% in 2021.

According to data retrieved from the African Development Bank, the Nigerian economy is expected to grow 2.9 percent in 2022. Also IMF predictions says that the Nigerian economy will increase by 2.7 percent in 2022, allowing GDP per capita to stabilize at current levels. The reason for this could be a rise in crude oil prices and production.

We are confident with the real estate market trend and that the sector will be typically bullish in 2022. Buyers and off takers are enthusiast about taking up space and new projects in the commercial and residential spaces are springing up all over the place, with 2022 as the anticipated delivery date of some top luxury projects.

It is expected that the real estate sector will have plenty of opportunities in 2022, as the real estate market continues to grow. Astute Investors will continue to invest money into all types of property investments, both notably luxury residential and grade-A office space. Because it is a pre-election year, the government is expected to play a significant role in policy formation to create an enabling climate for real estate investors at all levels of the value chain. This expectation extends to housing projects and interventions by the federal and state governments. However, due to unforeseen circumstances that may arise before and after the 2023 elections, some investors may expectedly adopt a “wait and see” approach.

Such an unforeseen event in the economy may be the withdrawal of oil subsidies, which could cause inflation and impair purchasing power, as well as other parts of the real estate value chain with increased building material costs, affecting developers and investors.

We anticipate that diaspora and foreign investors will be drawn to the real estate sector in 2022.

GDP Growth year on year 4.03%(year-on-year) Q3 2021 (Nigerian Bureau of Statistics)

GDP contribution real estate increased by 15.43% (quarter-on-quarter) Q3 2021 (Nigerian Bureau of Statistics)

Inflation rate December 2021 – 15.63% Q3 2021 (Nigerian Bureau of Statistics)

Projected economic growth 2.9 % in 2022(African Development Bank)

Projected economic growth 2.7 % in 2022(IMF)

Luxury Residential

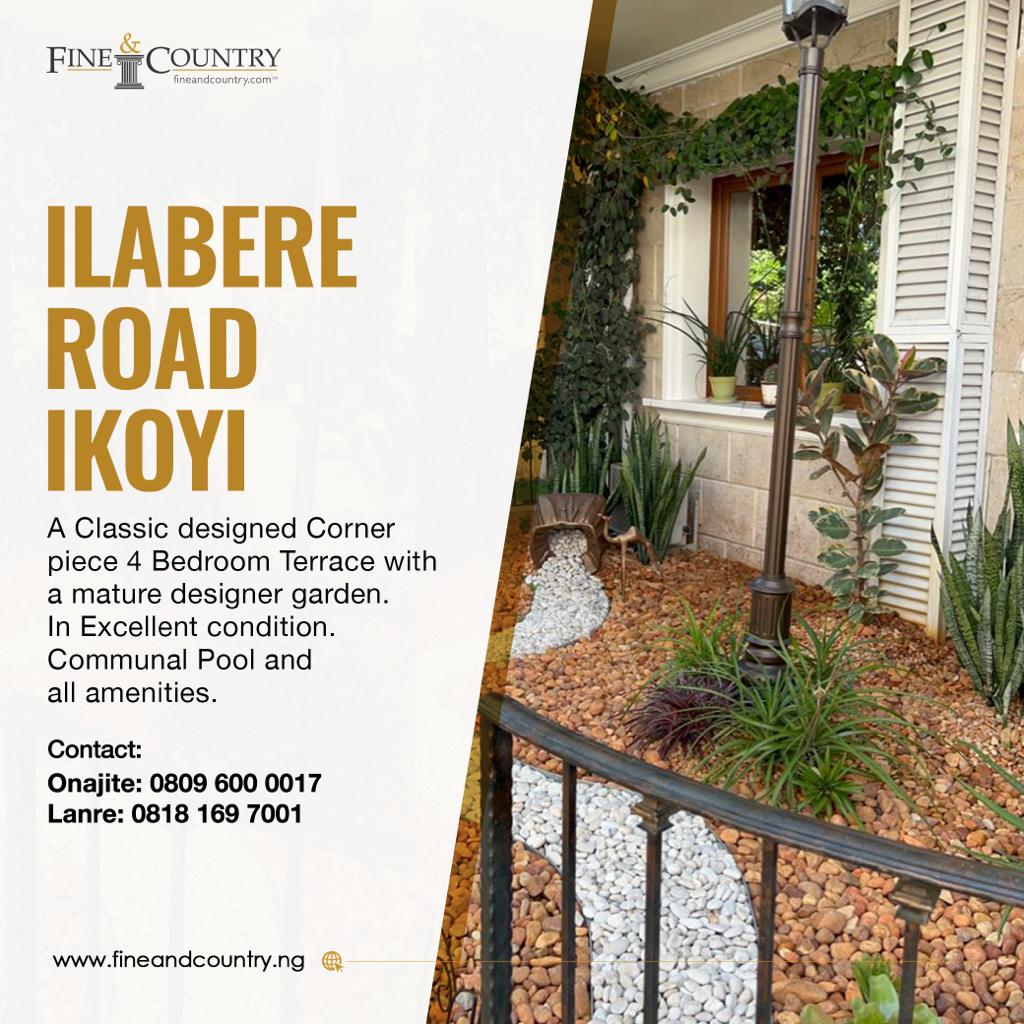

Tenants are increasingly looking for water-front apartments within the Ikoyi/ Victoria Island axis, as well as ample parking and huge living areas. This trend is likely to persist. Since the Pandemic, tenants have been more meticulous with space, particularly when it comes to setting up a home office, due to the rise in hybrid work styles.

The catastrophic collapse of a residential building in Ikoyi has taught investors to ask the correct questions and safeguard their interests when buying a luxury property. Before committing their cash, we want investors to be better informed about any developments in their fields of interest.

However, because of the increasing cost of building materials we expect prices of apartment/homes to increase but demand will also increase, particularly from Diaspora buyers who would take advantage of the weak naira to purchase real estate.

The Belmonte, along with Cuddle by Cadwell on Bourdillon, will be completed in 2022.

LUXURY RESIDENTIAL IKOYI

| PROPERTY | ASKING $ |

| Belmonte | 1.6M and above |

| Empire Court | 1.2M and above |

| 4 Bourdillon | 1.6M and above |

| Osborne Towers | 2M and above |

PIPELINE LUXURY RESIDENTIAL IKOYI

| PROPERTY | LOCATION | STATUS | ESTIMATED TIME OF DELIVERY |

| Belmonte | Bourdillon | Under Construction | 2022 |

| Cuddle by Cadwell | Bourdillon | Under Construction | 2022 |

| The Luxuria | Alexandra | Under Construction | 2023 |

| 39 Bourdillon | Bourdillon | Implementation | 2025 |

| Bourdillon Height | Moor road | Implementation | 2025 |

| NO 27 Glover | Glover road | Under Construction | 2023 |

PIPELINE LUXURY RESIDENTIAL VICTORIA ISLAND

| OFFICE BUILDING | LOCATION | STATUS | ESTIMATED TIME OF DELIVERY |

| The Knights Tower | Ahmadu Bello | Under Construction | 2024 |

| Azuri Towers | Eko Atlantic | Under Construction | 2022 |

2022 Anticipated Residential projects for Ikoyi and Victoria Island are Belmonte, Cuddle and Azuri Towers

Commercial Office Space

Because most organizations are adhering to tight health and safety procedures for their employees, the commercial office space has seen a gradual growth in uptake of space, resulting in the adoption of the hybrid style of work. However, we’ve seen businesses take up a lot of area and relocate from their current location. While some moved to get extra space, others had to give up some office space. According to our estimates, more businesses will occupy Grade A offices in 2022 as demand for large and small spaces grows.

We anticipate the completion of Famfa Tower in 2022, which will add to the pool of lettable space in Ikoyi.

The Nigerian Maritime Administration and Safety Agency’s purchase of Kanti Towers, Victoria Island, for N17.47 billion as its new headquarters in 2021 signals a surge in investor confidence, since inquiries to buy existing high-rise buildings in Ikoyi/ Victoria Island have increased.

However, because more stock is forecast in 2022, the uptake of office space may be slowed down. There are already existing stocks that are not being taken on the market as companies like BUA and Dangote are developing head offices.

OFFICE RATES IKOYI

| OFFICE BUILDING | RATES /ASKING $ | REALISED $ |

| On6Temple | 650 | 600 |

| Kings Towers | 1000 | 850 |

| Heritage Place | 750 | 700 |

| Alliance Place | 750 | 700 |

| No 47 | 600 | 550 |

PIPELINE OFFICE IKOYI

| OFFICE BUILDING | LOCATION | STATUS | ESTIMATED TIME OF DELIVERY |

| Famfa Oil Tower | Alfred Rewane | Under Construction | 2022 |

| Dangote HQ | Alfred Rewane | Under Construction | 2023 |

| BUA GROUP HQ | Alfred Rewane | Under Construction | 2025 |

| Meristem Securities Office | Gerrard road | Under Construction | 2022 |

| NDIC Head Office | Glover road | Under Construction | 2024 |

| NO 27 Glover | Glover road | Under Construction | 2023 |

OFFICE RATES VICTORIA ISLAND

| OFFICE BUILDING | RATES /ASKING $ | REALISED $ |

| Postsquare | 450 | 380 |

| NestOil Towers | 800 | 750 |

| Greystone | 550 | 450 |

| The Wings | 700 | 650 |

| Number One | 700 | 600 |

PIPELINE VICTORIA ISLAND

| OFFICE BUILDING | LOCATION | STATUS | ESTIMATED TIME OF DELIVERY |

| Dover Tower | Ajose Adeogun | Under Construction | 2023 |

| Crystal Tower | Ademola Adetokunbo | Under Construction | 2024 |

| Head Office Development for First Pension Custodian Nigeria Limited | Akin Adesola | Under Construction | 2023 |

| 40 Adetokunbo Ademola Street | Ademola Adetokunbo | Under Construction | 2022 |

| Stanbic IBTC HQ | Ozumba Mbadiwe | Under Construction | 2024 |

2022 Anticipated office projects for Ikoyi and Victoria Island are Famfa Oil & Meristem Securities Office