Our economy is looking up once again having exited a 13-month crippling recession. But real estate is still lagging even when it is supposed to be a growth driver. How do you explain this?

Real estate is a solid asset class that mirrors the economy. It’s therefor unusual that it will be sluggish during a recession. It’s impossible for real estate to drive growth when the other fundamentals that drive real estate growth are not in place, including factors like monetary to economic policies, mortgages, and lower purchasing power. As much as housing is a necessity, it does not exist in a vacuum. People will take care of basic needs such as food and clothing at the lower end of the market, while at the premium end, corporates and high net worth individuals will attend to restructuring, in most cases downsizing their real estate requirements and budgets to suit a leaner business structure, as part of risk management. As such real estate will lag for a while, even as the economy recovers slowly. There are obviously more liquid and lower value assets that act as interim safe houses for investors including treasury bills and foreign currency hedges. Long-term, however, real estate catches up and overtakes the market, leading sometimes to what’s called a bubble. We are however a long way from any such heady investment climate, as bubbles are caused when there is excess liquidity and over confidence in the economy.

In economic parlance, this sector is described as a laggard, always shifting after the economy must have shifted. How soon or otherwise do you think it will take for the sector to come around?

As indicated earlier, real estate is best viewed as a long term asset and is not as liquid or easy to invest or dispose of especially in a developing economy. As incredible as the potential of the sector is, there simply has not been as strong an investment from all relevant stakeholders to ensure that it delivers the growth that it is capable of. Despite the NMRC which was established to stimulate private mortgages through the PMis at specific thresholds, is not yet delivering the impact. The Economic Recovery and Growth plan is itself a recovery plan, and as it takes effect, along with improved business confidence, we can expect to see it rub off on the real estate sector. In the meantime, the sector is in for a long haul of readjustments and needing reinvention across all segments but especially at the premium end of residential and offices, if it’s to deliver the growth expected of it. Serious real estate stakeholders are however not expecting to do business as usual, and that’s a good thing. It’s times of difficulty that brings out the best from those willing to adapt. I think better a slow reawakening of the sector with sustainable private investor strategies, regulatory structures, and policies than shallow growth.

You and your collaborators, particularly BusinessDay, are perfecting plans to take Nigeria to the World early October. What story are you going to tell?

There’s so much that is positive about Nigeria while there’s a lot that still requires correction leaving room for growth and in some cases radical change. Our governance structures are a weak link and one that organizations such as ANAP Foundation and many other Non-Governmental Institutions are focused on building. That’s a good thing when we have private sector leaders who have no desire to play the ostrich just because they are not in full-time public service. They realize that the business climate and economy play a major role in their long term financial and corporate well being, but more importantly for the future generation. Real leaders think generationally. And so through this two-day event, we will we draw attention to and celebrate leadership, both in the private and public sector. We will highlight the fact that there are good leaders in Nigeria, have been and will continue to be. In addition, by drawing attention to various leading corporate brands not just in Real Estate, but home grown institutions, whether it’s Access Bank, Stanbic, First Bank, Seplat, Platform, Famfa Oil, South Energyx, Landmark, Crown Ltd and numerous others, we demonstrate that the story of Nigeria cannot be told without the private sector. It’s the leading brands, the selfless and visionary leaders in various sectors, and the innovative and astute real estate companies that champion change that we want to celebrate. We have to remember that most sectors of the economy interact with real estate and we have a story to tell about the real estate companies setting the pace and blazing trails even within the difficult terrain. The public sector, of course, cannot be left out, because to a large extent they set the temperature and climate of the economy. From security to education, infrastructure, health, housing, monetary policies, there are all relevant, and it’s our intention not to whitewash the reality of our painful pathway to development in all these areas, but we can’t focus only on the difficulties or deficiencies without identifying and celebrating what’s positive, no matter how incremental. The work of the Trade Minister and his team, representing our president, with the ease of doing business campaign and the progress made with investors being able to easier entry, the Lagos state initiatives around title registration, and some of the latest and exciting new cities and projects going on in Nigeria from Enugu to Kano, Abuja, Ogun State, Lagos, Port Harcourt are all areas to be showcased. Our aim is to provide accurate and current insight on the real estate sector and the economy as a whole. We want to help shape the narrative more accurately by sharing the positives as well as the areas of desired growth. No nation can survive if its nationals are not proud of their country. We have a responsibility to deliberately craft platforms that enable us to showcase the best stories of our nation, its people and its path to greatness. That’s why we are kicking off the Refined Investor Series with an Independence Celebration Dinner on Friday, October 6th. We want to celebrate our country, its people, both local and in diaspora and the initiatives, brands, and projects that are contributing to it positively.

Tell us more about this epoch event already scheduled for London where you intend to present the best of Nigerian real estate market to international investors.

The Refined Investor Series (RIS) Event is a 2-day Series. An Exclusive Independence Celebration Dinner themed, I.L.E.A.D: “INDUSTRY LEADERSHIP, ENTREPRENEURSHIP ATTITUDES & DEVELOPMENT” will be hosted on October 6th Friday evening at the prestigious and historic Landmark Hotel, London. We will be celebrating Nigeria’s 57th independence, visionary leadership in projects and financial institutions shaping the Nigerian Real Estate sector while encouraging networking with private wealth clients and leaders in Diaspora. The full day Premium but Free Access Investor Series and exhibition will hold on Saturday, October 7th in the same location. The Exhibition and Seminar will feature an extensive exhibition from all our partners and stakeholders providing direct engagement with diaspora and international investors.

The Eko Atlantic City is one of the prime projects you intend to present to investors as Nigeria’s flagship project. How are you going to manage concerns about inclement weather conditions, environmental impact and all?

In actual sense, there is a real dearth of knowledge about the Eko Atlantic project and its impact on the Environment. At the start of the Eko Atlantic project, an Environmental Impact Assessment Report was commissioned and granted to Royal Haskoning, a leading EIA firm in consultation with the Federal Ministry of the Environment and the Nigerian Port Authority (NPA) as well as Lagos State Ministry of the Environment (LASMOE). The Eko Atlantic Shoreline and Reclamation Project seeks to provide approximately 1000 hectares of high-quality land for development within the heart of Lagos, and will indeed offer a long-term solution to the shoreline erosion problems at Victoria Island, Lagos but many people are unaware about the major positives. That’s why one of our objectives is to address the myths and misconceptions surrounding real estate in Nigeria. Fears around the Eko Atlantic are largely unfounded and relies on the assumption that all things Nigerian are fraught with a substandard approach. However, that premise is faulty and not supported by both local and international observers of this We have to remember that successive federal and state governments have been involved in certifying this project, including former Governors Tinubu, and Fashola, and now current Governor Ambode. It would take an incredible level of conspiracy to expect that every one of these leaders will turn a blind eye to something so significant. In addition, we have some of the most highly regarded diplomatic missions, and financial institutions already actively working on their new head offices and embassies at the Eko Atlantic. This simply wouldn’t be possible if they didn’t carry out the highest level of assessments themselves. The Refined Investor Series is a great opportunity for the developers of the Eko Atlantic who are being represented at the very highest level by Ronald Chagoury Jnr and his team to engage directly and address the misconceptions. I must say, this is unarguably Africa’s boldest and most visionary project.

Some people say that in spite of the situation in the market, there are still pockets of opportunities that investors can latch on and get good returns. Do you share this view? If yes, where?

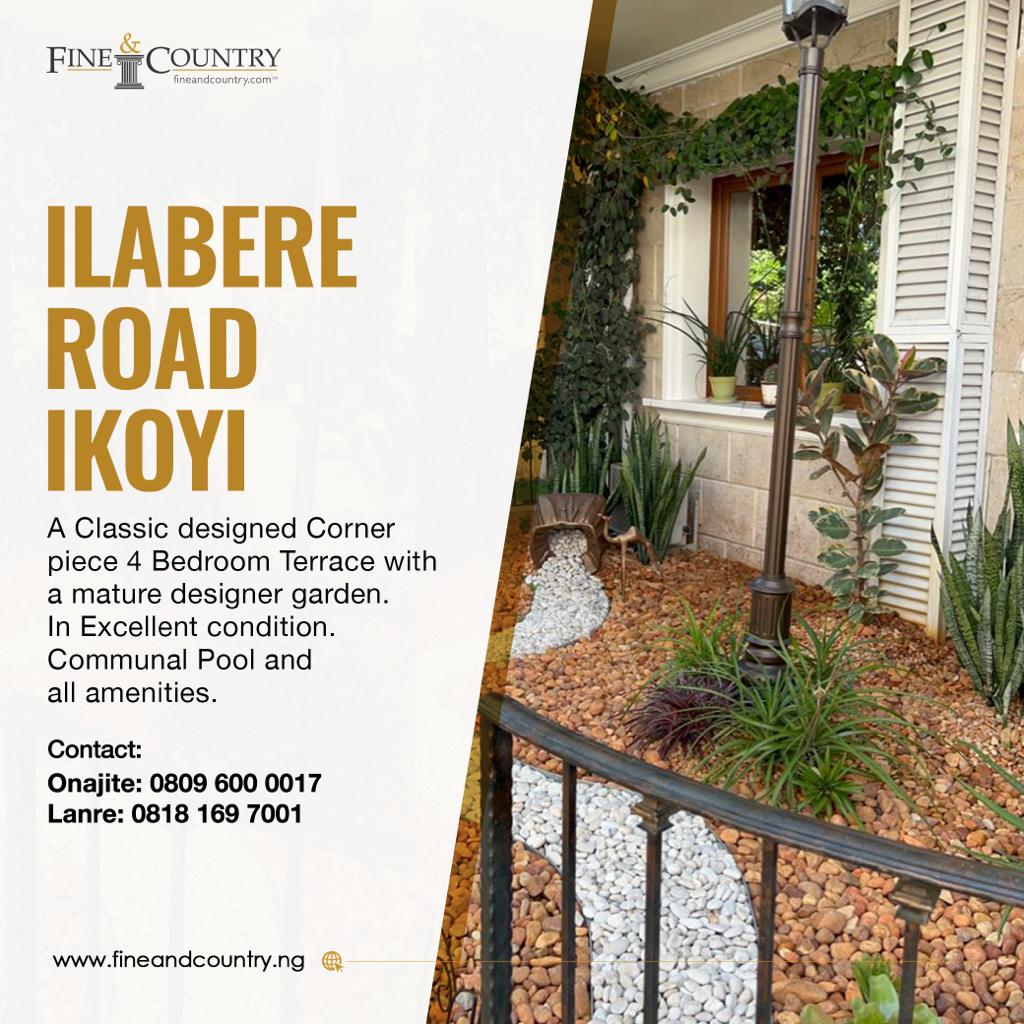

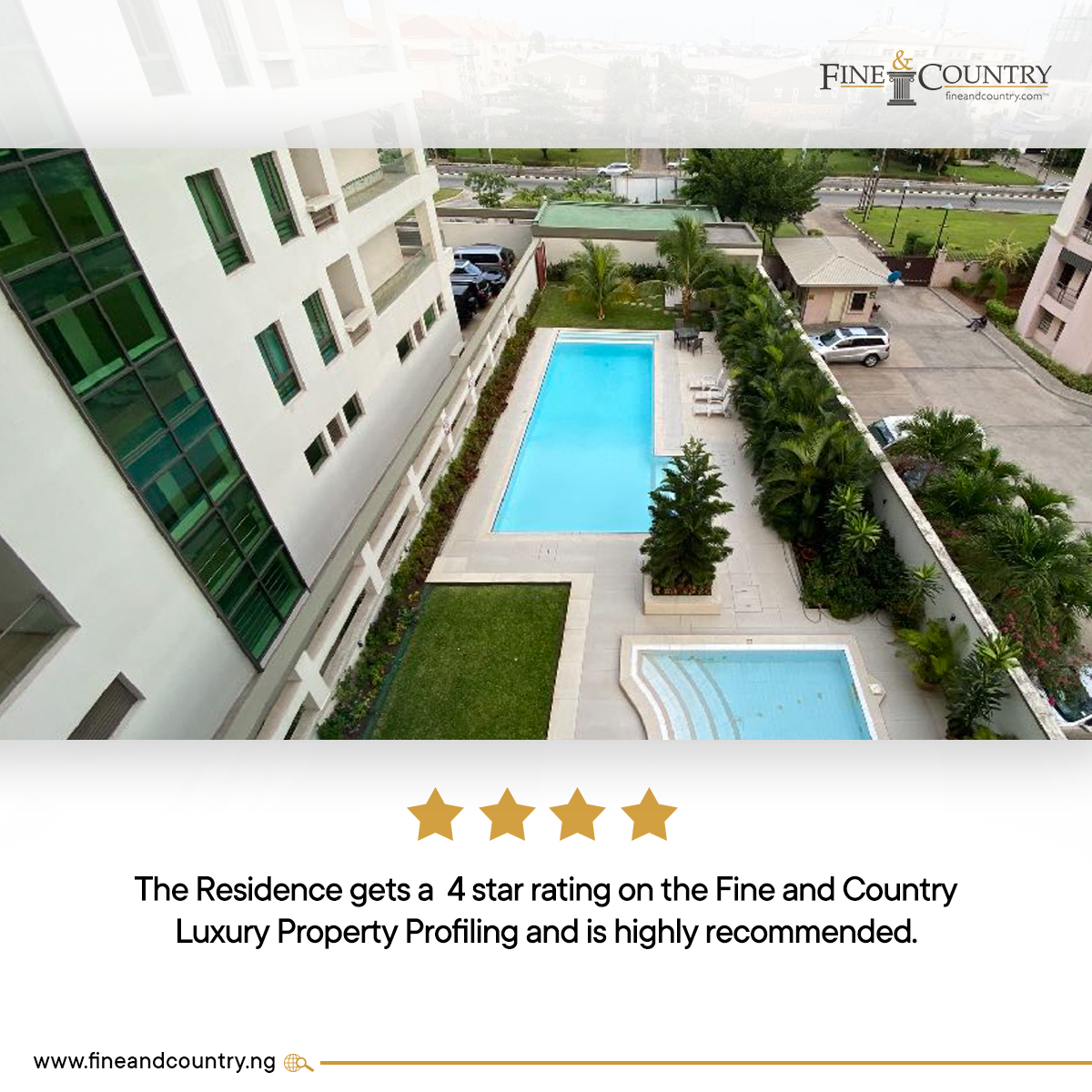

I’ll restrict my comments to the opportunities for mid level to prime real estate in the residential and office market in a severely contracted market. Fine and Country’s main business is in the upper quartile, and we are very familiar with recessionary markets, considering our launch in 2008, the height of the market crash. We have, however, always maintained that astute investors understand that every market not only has cycles but that within each cycle, real investors don’t look for last seasons opportunities. Astute investors engage a creative and intelligent process to unlock opportunities irrespective of the market cycle.

With mid to prime residential, we believe that the top executives, mid level professionals and High Net worth Diaspora investors present a unique opportunity for residential developers. 25% of our clients in the last year has come from Nigerians based overseas. The main reason is the currency advantage that came as a result of the Naira devaluation. This is a largely untapped and confusing market for most Nigerian developers who tend to go after them sporadically without a well articulated and coordinated strategy for not just exposing their projects but creating the right narrative that resonates with their target market. Back home, the mid level entrepreneurial class (long standing business owners with some measure of liquidity and stability looking to downsize and relocate to more convenient locations) or to invest their capital in an inflation proof solid long term real estate, are a segment for developers who are willing to be creative recognising that their needs are unique. Good quality properties, in residential and office segment, is still not to be taken for granted. With quality, however, our view is that developers need to be mindful of balancing quality with ability and pricing, and with purchasing power significantly reduced, value pricing remains important while more efficient spaces and flexible terms have become important. The heady days of $1000 per square meter for prime offices have clearly taken a break, and prices are now at a more sustainable $500-650m2 for prime offices, with quarterly to bi-annual payments now becoming the standard. Although there are still long term leases being signed, those are few and far between, and typically pre-arranged.

Are there still opportunities for ultra luxury residential, the answer is yes if you have staying power, meaning long term funds, patient or legacy capital as I prefer to call it. The true luxury market will never really disappear, as luxury is a reward for extreme hard work and having attained a certain height in life. At this point, people don’t ask mundane questions. Perhaps, the thing to note is that most people who say the luxury market have disappeared, are really referring to the aspirational luxury market or the ‘white market’ of undisclosed source money who may be uncomfortable to invest in a more accountable economy. There’s a difference with real luxury level investors and it’s always been a tiny sliver of the market. In any case, real luxury developers who don’t have patient capital, shouldn’t be in the game. Invest in this segment only if you can afford to outride the market, while of course taking on board market feedback and ensuring you provide real luxury. The low to mid price point residential, office and retail segments remain the highest growth potential, but it’s a game of numbers and a race to slimmer margins that will benefit from higher efficiency in construction and customer service delivery. This market believe it or not is still anyone’s game and not yet dominated by any player. There’s an opportunity for an existing luxury developer to pivot in this direction with economies of scale and dominate specific locations. I could go on, but hopefully, you can see there are still opportunities.

Let me take you back to the London event. The diaspora and international investors you are going to woo to Nigerian market are people used to mortgages as a means of buying property. But here’s is a country where mortgage is virtually non-existent. What argument are you going to present in this respect?

A: It’s true that the Nigerian mortgage infrastructure is weak compared to the highly structured mortgage frameworks in the UK, the US, and Europe, however, that in itself presents opportunities for Investors and Developers alike. Most developers offer flexible payment plans, and longer payment periods, which is an attraction for potential investors especially when tied to their cashflow. Indeed many projects in Nigeria have routinely been sold through creatively structured payment plans.

For buyers, even though these real estate investments may be capital intensive at first, there is the potential to save more than the total repayment sum of the mortgages which include the principal amount plus the interest especially in a high-interest environment. Investors also have the opportunity, to avoid the fees associated with mortgages by buying directly with developer flexible financing.

I think in working with the current weaknesses that surround the Mortgage Infrastructure, it is important not to overlook, the downsides, of the high-interest rates, and the overall increased cost influenced by interest rates. Despite these challenges, it’s interesting to note that there are banks who have become creative about Diaspora credit and this is an area that will be discussed extensively at the Refined Investor Series in London. We have one of Nigeria’s leading financial institutions, Access Bank Plc whose dynamic Group Managing Director, Herbert Wigwe is fully committed to engaging diaspora investors using Access Bank UK and its global footprint to tackle this effectively. Indeed the topic of Creative Diaspora Financing is at the fore front of our discussions at the upcoming event.

For too long, the Nigerian mortgage system has remained a fledgling. Where do you think the operators are getting it wrong? What, in your opinion, needs to be done to get it right?

Ultimately, we agree that the best chance of Nigerian real estate playing a real role in economic growth is to have a viable and sustainable mortgage system and we can all agree that this currently doesn’t exit. We have to however, agree that this is not a mortgage operators deficiency, it’s a market deficiency. We don’t completely have the right enabling structures, although the Nigeria Mortgage Refinance Corporation is an attempt towards stabilizing that sector. The real issues are more fundamental and go to our very economic, financial and legal regulatory framework. Transparency and enforcement of title remain a slow trudge. Double digit interest rate regimes nearing 25% due to the lack of liquidity, and long term funds, combined with uninspiring monetary regimes, are all factors. A lack of strong formal employee market means that it’s a challenge for mortgage providers to conduct an objective assessment of many applicants. The list goes on. This issue is one that requires a holistic review, otherwise, we may end up seeing mortgage companies convert their businesses and become real estate development companies because at least they will not be subject to the stringent regulatory supervision, while they’ll be in a position to be more creative with buyers financing.

Looking back to when you started this event (the Refined Investors Series), what impact do you think it has had on the Nigerian real estate market? What are the prospects in the years ahead?

Our key objective and mission through the Refined Investor Series has always been to ‘inspire confidence’ in the Nigerian Real Estate Market through providing a platform for good quality information, insight, and intelligence. As a company, we are on a quest to raise the standards in the real estate sector to international levels so that we become an attractive destination for our own citizens wherever they live, as well as international investors. We believe that limited transparency, access to current and accurate data, are major weaknesses of our economy and certainly the real estate market. Investors, whether local, diaspora or international go where they are confident. Confidence is inspired when people feel they have the right information and an understanding of the market. Our vision is to help investors invest more intelligently and confidently as a result of the Refined Investor Series.

The previous editions of Refined Investor Series held in Lagos has had in attendance over 1000 private investors over the past 5 years, with speakers and participation from notable personalities such as Mr. Atedo Peterside, Chairman of ANAP Foundation and formerly of Stanbic IBTC , Mr. Jim Ovia, Chairman of Zenith Bank and Quantum Capital, firms such as Elalan Construction, ANAP Business Jets Limited, British High Commission, Trustbond Mortgage Bank, YF construction, Lakepoint Properties, Urban Shelter Ltd, Famfa Oil Ltd, Total Nigeria Plc, Lagos Business School, Stanbic IBTC Bank, First Bank Private Bank, AM Facilities, Fidelity Bank, Palton Morgan Group, JLL, Energo Buildings , UPDC, LGV Gas.

Seeing top level investors, developers and stakeholders make decisions based on insight gained at the Refined Investor Series, is the proof of its impact. Our ultimate objective is to shape the Nigerian Real Estate sector positively, so that we can unlock the real wealth that exists within it for many more investors, especially at the mid to prime markets. That’s our focus, and we intend to continue to scale this up using both technology as a way of reaching more investors with the relevant investment information. Next year just before the summer, the Refined Investor Series will debut in the US and Canada, with a Lagos and Abuja edition in February 2018 (The Economic and Real Estate Outlook Edition) in collaboration with our standing partners Business Day, and an ‘Astute Investor Seminar for High Network Clients in April, 2018.

We also have a gender focused Real Estate Series, the Finer Wealth Series, which helps to shape the way female investors tackle real estate and build financial security. This has been on for 3 years now and will formally launch the first female property investment club later this year. For now however, our 100% full on focus is on the London Series, as all roads lead to the Refined Investor Series, UK Diaspora and International edition at the Landmark Hotel, London on October 6th and 7th in a few weeks.